In the fast-paced world of food delivery, Zomato has become a household name for millions of Indians craving quick meals. But behind the seamless app experience lies a growing frustration among restaurant owners: sky-high commission rates that eat into profits. As we dive into Zomato commission rates 2025, one viral story from a Delhi-based eatery owner is making waves, exposing how promotional “growth investments” can slash payouts to a fraction of what restaurants earn. If you’re a small business owner partnering with Zomato or just curious about the platform’s business model, this breakdown reveals the real numbers – and why change might be on the horizon.

The Shocking Payout Story That’s Sparking Outrage

“This is what #Zomato is doing, they assign an account manager who fools you out in the name of ads and run them to suck your profit. #pmoindia #pmo. Should there be any limitation on #Zomato? Out of Rs 4,353 rupees, I am only getting Rs 1,100 after 2X sale promise by Account Manager.”

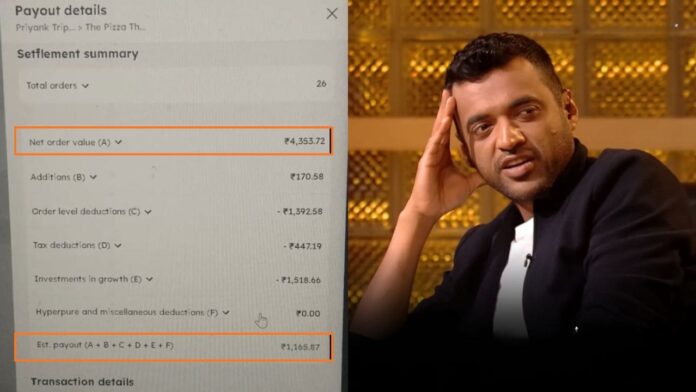

Picture this: You’ve hustled all week in your kitchen, serving up 26 orders worth over ₹4,353 through Zomato. Sounds like a win, right? Not for Saurabh Gupta, owner of a modest restaurant in Delhi. In a raw, unfiltered post on X (formerly Twitter) earlier this month, Gupta laid bare his payout shock: after all deductions, he pocketed just ₹1,165 – that’s less than 27% of his gross sales.

Gupta didn’t hold back in his tweet, tagging India’s Prime Minister’s Office with hashtags like #pmoindia and #Zomato.

“This is what #Zomato is doing,” he wrote. “They assign an account manager who fools you out in the name of ads and run them to suck your profit. Out of Rs 4,353 rupees, I am only getting Rs 1,100 after 2X sale promise by Account Manager. Should there be any limitation on #Zomato?”

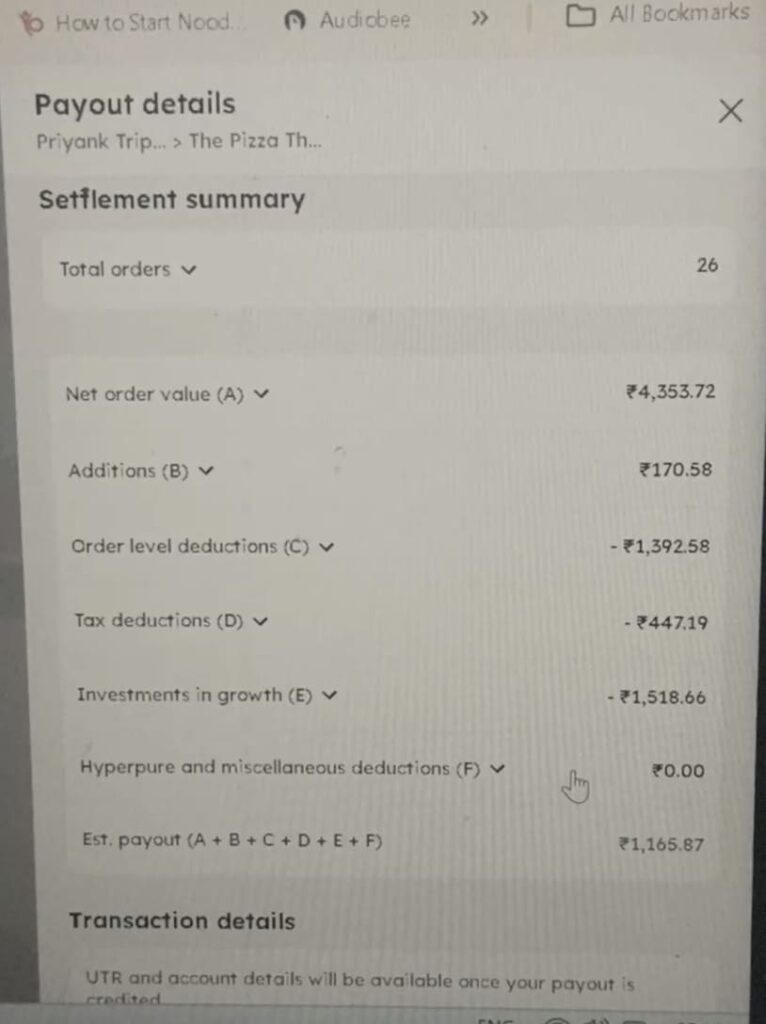

Attached to his post was a stark screenshot of the payout summary – a table of cold, hard figures that any restaurant owner would dread. Here’s a quick look at the breakdown:

| Category | Amount (₹) | Notes |

|---|---|---|

| Total Order Value | 4,353.72 | From 26 orders |

| Order-Level Deductions | ~500 (est.) | Platform fees per order |

| Tax Deductions | ~169 | GST and other taxes |

| Investments in Growth | 1,518.66 | Ads and promotions charged back |

| Final Estimated Payout | 1,165.87 | What the restaurant actually receives |

This “Investments in Growth” line? It’s Zomato’s fancy term for advertising spends – the very promotions Gupta says were pitched as a ticket to double his sales. Instead, it felt like a trap, turning promised growth into a profit drain.

Gupta’s story isn’t isolated. On Reddit, small restaurant owners are venting similar gripes, with one post from October 9, 2025, titled “Zomato commission charges is too high,” pleading for relief to keep their doors open. It’s a reminder that while Zomato’s app boasts 900,000+ targeted keywords for customer searches like “restaurants near me,” the backend math often leaves partners scraping by.

Zomato’s Quick Response – And Why It Fell Flat

Zomato didn’t let Gupta’s tweet simmer. Within hours, their official X handle chimed in with a polished reply:

“Hi Saurabh, we understand your concern and would like to take a look at this. Please send us a DM with your restaurant ID so we can assist you further.”

Gupta shot back: “I knew that you guys won’t assist. #Zomato #pmoindia.” Undeterred, Zomato doubled down: “We are committed towards resolving your concern and are here to help. Please share your registered mobile number or restaurant ID via DM.”

It was textbook crisis PR – empathetic on the surface, but generic enough to feel scripted. As of late October 2025, there’s no public update on a resolution, leaving many to wonder if these exchanges ever lead to real refunds or rate tweaks. For restaurant owners scrolling through similar threads, it’s a stark signal: advocacy starts with your voice, not just a DM.